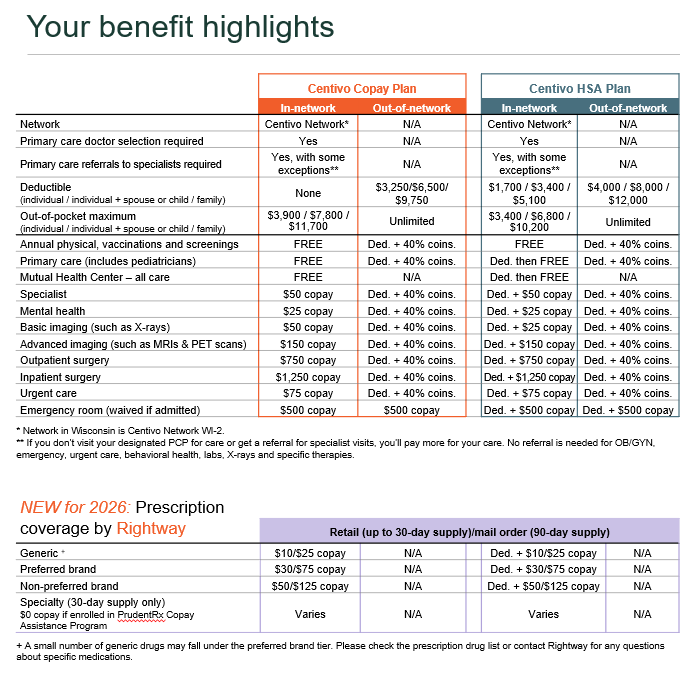

Choose the plan that's right for you: Centivo Copay or Centivo HSA

The Centivo plan options offer high-quality care at lower costs through a vetted network of providers. You have two plans to choose from so you can pick the plan that best fits the needs of you and your family. All plans provide the same comprehensive coverage, from unexpected emergencies and hospital visits to routine expenses such as preventive care, mental health and physician visits.

Centivo Copay Plan

No upfront costs

The plan has no deductible, so there are no upfront costs you must pay before your benefits kick in.

Know what you owe before you go

Set copays mean you’ll know what you owe – if anything – before you go to the doctor, with no surprise bills.

FREE doctor visits

You’ll get FREE visits with your personally selected primary care doctor and providers at the MHC. See them as often as needed to stay as healthy as possible.

Right care, right time

Your primary care doctor will refer you to in-network specialists for high-quality care to meet your needs.

High-quality healthcare providers

Access to a vetted network of local, virtual and national healthcare providers for quality care when and where you need it.

Medical coverage when traveling

Away from home? Urgent care is covered as in-network when outside the Centivo Network area, and emergency care is covered as in-network no matter where you are.

Centivo HSA Plan

FREE doctor visits after deductible

After you meet your deductible, you’ll get FREE visits with your personally selected primary care doctor and providers at the MHC. See them as often as needed to stay as healthy as possible.

Right care, right time

Your primary care doctor will refer you to in-network specialists for quality care to meet your needs.

Know what you'll owe

Once you meet your deductible, you’ll have set copays so you’ll know what you owe – if anything – before you go to the doctor.

High-quality healthcare providers

Access to a tailored network of local, virtual and national healthcare providers for quality care when and where you need it.

Tax savings with an HSA

Contribute pre-tax dollars from your paycheck into a health savings account (HSA) and use that money to pay for qualified medical expenses now or in the future.

Medical coverage when traveling

Away from home? Urgent care is covered as in-network when outside the Centivo Network area, and emergency care is covered as in-network no matter where you are.

Is a Centivo plan right for you?

If any of these apply to you, you should consider moving to a Centivo plan.

- I use the Mutual Health Center (MHC) for primary care today.

- I see doctors in the Centivo Network and want to continue to see them.

- I’m willing to change to an in-network doctor.

- I visit urgent care or the emergency room whenever I need care instead of seeing my doctor.

- I want a primary care doctor to help guide my care.

View your 2026 benefit summaries

Need more information to help decide which plan is right for you? We’ve got you covered. View a high-level benefits summary (click image). Or, read the Summaries of Benefits and Coverage (SBCs) for even more detail.

How it works

Take these 3 steps to get the most from your plan

Step 1: Pick a Doctor

- Choose a primary care doctor, a step Centivo calls activation.

- If this is a new doctor, schedule an appointment, so they can get to know you and your healthcare needs.

- If you activated last year, you don’t need to activate again.

Step 2: See your doctor first for any healthcare needs

- Your doctor can help you stay as healthy as possible.

- When you get sick, your doctor can identify the issue and start treatment.

- If you have ongoing conditions, your doctor can help you manage them and make medication adjustments.

Step 3: Get referrals for specialty care

- Get a referral from your primary care doctor when you need specialist care.

- They’ll send the referral to Centivo for you, and it will be good for one year.

- All you need to do is make sure you see the referral in your Centivo app prior to seeing the specialist.

Understanding key insurance terms

The amount you pay out-of-pocket before the plan pays towards your healthcare costs.

A fixed dollar amount you pay for a healthcare service or visit.

The percentage of costs you’re responsible for after you meet your deductible. If coinsurance is 40%, you’ll owe 40% of the cost after you reach your deductible.

The most you’ll pay for any covered healthcare expenses during the plan year.